Trucking revenue increasingly flows to biggest carriers

|

Apr 09, 2015 at 11:18 AM CST

|

|

|---|---|

|

William B. Cassidy, Senior Editor

http://www.joc.com/trucking-logistics/trucking-revenue-increasingly-flows-biggest-carriers_20150408.html

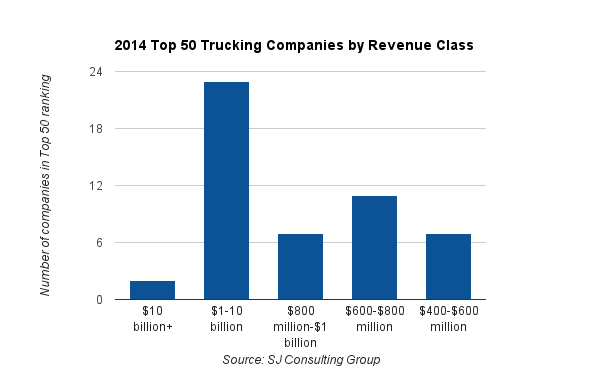

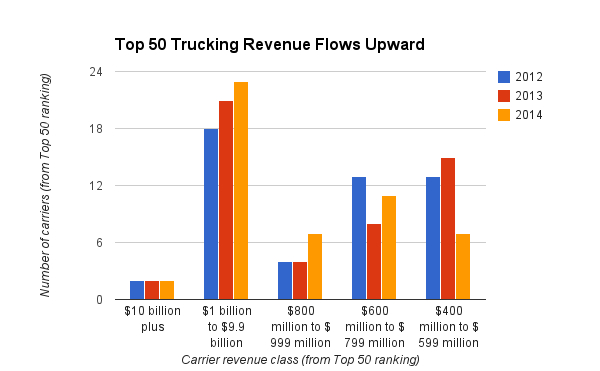

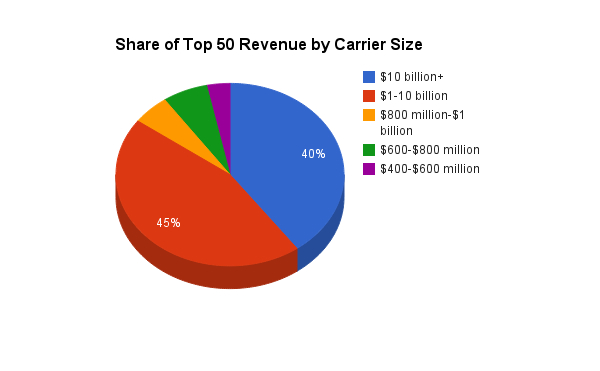

In the U.S., trucking is considered a "fragmented" industry, with hundreds of thousands of carriers, many of the fielding only a few trucks, hauling freight across the continent. However, trucking revenue has become increasingly concentrated, as the number of carriers with more than $1 billion in annual revenue more than doubling over the last decade. That’s a sign of not only economic growth and a maturing industry but a shifting freight market that depends more on large companies that can deliver substantial amounts of capacity. The long-term result, according to SJ Consulting Group, will be a more efficient and profitable group of big carriers and better transportation options, services and pricing for shippers. The growing number of large motor carriers is good news for shippers that can’t effectively tap capacity from smaller carriers without help from a third-party logistics partner. How concentrated has trucking revenue become? In 2013, the American Trucking Associations reported for-hire motor carriers of all types had $376.1 billion in revenue. According to SJ Consulting Group data, $89.8 billion of that for-hire revenue figure from the ATA — 24 percent of the total — went to just 23 U.S. trucking companies. Keep in mind there are more than 500,000 registered trucking firms, and the number of active, available carriers last year was close to 200,000, according to QualifiedCarriers.com. Last year, 25 trucking firms with more than a billion dollars in revenue, from UPS to Southeastern Freight Lines, had $99.5 billion in revenue, according to SJ Consulting Group. That’s 85 percent of the $117 billion in combined revenue of the 50 largest U.S. motor carriers, according to the SJ Consulting Group/JOC.com Top 50 Trucking Companies report. In comparison, there were only 12 trucking companies with more than $1 billion in revenue in the 2003 Top 50 rankings, starting with UPS and FedEx and ending with Werner Enterprises. In that year, those 12 carriers had $44.8 billion in combined revenue and accounted for 71 percent of the $63 billion in total combined revenue of the Top 50 Trucking Companies.

Over the last decade, the revenue stream that feeds the Top 50 trucking firms has flowed uphill. As total Top 50 revenue rose 86 percent, The revenue of the billion-dollar carriers in the rankings rose 122 percent. Even in 2009, when all but one of the Top 50 carriers saw revenue plummet, there were 13 companies with at least $1 billion in revenue, down from 17 companies in 2008. That means 12 carriers have raised revenue above $1 billion since the end of the recession. In the last two years alone, six carriers have passed the $1 billion revenue mile mark. Crete Carrier, Roadrunner Transportation and Averitt Express passed that bar in 2013 and Knight Transportation, Southeastern Freight Lines and TransForce (in the U.S.) in 2014. The trucking companies on the list with less than $1 billion in annual revenue are getting bigger as well. Last year, not one Top 50 carrier had less than $500 million in revenue. In 2003, there were 23 carriers in the rankings with less than $500 million in revenue, and the smallest of the Top 50 that year, Oak Harbor Freight Lines, had $111 million in sales. “Part of this is acquisitions,” Michael J. Scheid, senior analyst at SJ Consulting Group said, pointing to the growth of companies such as Roadrunner through multiple acquisitions. In addition, large companies such as Old Dominion Freight Line and Estes Express have boosted revenue by diversifying services and building a more national footprint, he said.

But trucking, always a big business, is certainly getting bigger. The revenue concentration among big carriers is likely to increase, Satish Jindel, president of SJ Consulting, said. “With more and more regulations coming, and more technology needed to comply with those regulations, the larger trucking companies are going to be getting larger,” Jindel said. That’s a good thing for large shippers in particular, he said. Those companies rely on large carriers, and when they can’t get capacity from them, on 3PLs and freight brokers. And even with a quarter of for-hire trucking revenue going to perhaps 25 companies, the level of concentration is far from being high enough to threaten competition, Jindel said. “For most shippers, there’s a list of 15 to 20 carriers they can use, by region and by type of freight,” Jindel said. “They don’t have to be concerned about not having enough choices.” Contact William B. Cassidy at [email protected] and follow him on Twitter: @wbcassidy_joc |

|

1340 E Woodhurst Dr Springfield, MO 65804